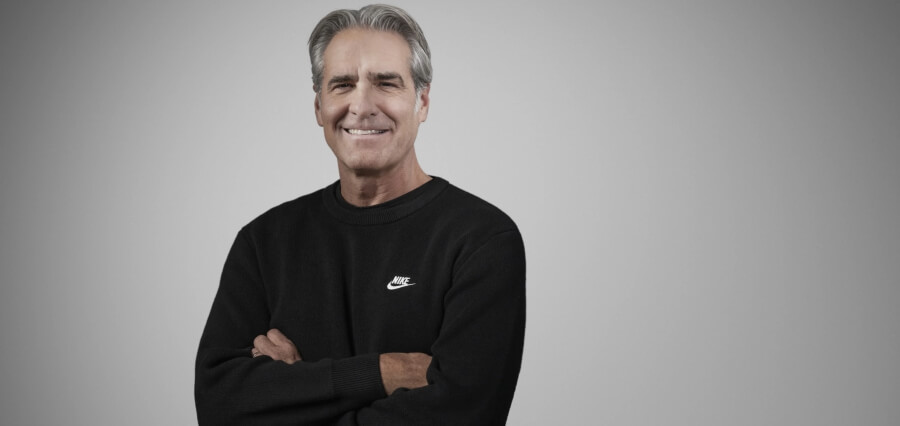

Nike CEO Elliott Hill has outlined a strategic vision to steer the company back on track after recent results revealed a decline in both revenue and profit. The company’s performance was notably impacted by falling average selling prices, a significant factor driven by aggressive discounting. Hill, who rejoined Nike in October after a 30-year tenure, emphasized the need for a renewed focus, a commitment to the company’s core values, and a return to a more disciplined business approach.

Hill acknowledged that while promotions had been used to drive sales, particularly in Nike’s digital channels, this strategy had hurt both brand equity and profitability. The company had experienced a shift towards a 50/50 split between full-price and promotional sales, which undermined margins. Nike plans to phase out this promotional approach, starting by clearing out inventory from less profitable channels. Looking ahead, Nike is forecasting a decline in gross margins of 3 to 3.5 percent during the holiday quarter, with sales expected to fall by low double digits, a figure that exceeds analysts’ prior projections.

Despite all this, Nike was able to beat Wall Street expectations during its second-quarter for 2025. Its earnings were reported at 78 cents per share in revenues of $12.35 billion. However, the company underperformed compared to the same quarter last year, with net income decreasing from $1.58 billion to $1.16 billion, and sales falling by 8%.

Hill, who started his career at Nike in the 1980s and held several leadership positions before leaving in 2020, has criticized the previous management’s obsession with digital sales and performance marketing. According to Hill, under his leadership, Nike will rebuild relationships with wholesale partners, an essential part of its business, and focus on delivering products closer to its sports and performance heritage. He also claimed that the company previously placed too much emphasis on highly fashionable lifestyle sneakers like Air Force 1 and Dunks which became highly popular and flooded the market.

All geographical segments of Nike witnessed sales decline in terms of performance across the world. The Asia-Pacific region, with a sales decline of 8%, witnessed the biggest drop in percentage. North America and Europe outdid the estimates of analysts though sales for them declined by 8% and 7%, respectively.

Some of Hill’s early triumphs include winning a renewed contract with the NFL, giving Nike an even stronger stand in sports partnerships. On the other hand, there is still some time needed before these challenges can forget. Hill’s focus will be on getting Nike back in its roots in sport, improving profitability and restoring brand strength, therefore placing the company on a long-term recovery pathway.